Como encontrar advogados especialistas em diversas áreas jurídicas

Tragbare Treppenlifte 2025 für Senioren: Unabhängigkeit und Bequemlichkeit ohne Installationsaufwand

Como comprar carros seminovos sem entrada

Procurando um carro econômico? Veja o fiat argo preço usado!

2025 Hyundai Tucson: The Ultimate Compact SUV

9 Cartões de Crédito para Negativado com Limite Aprovado na Hora

The Evolution of Auto Insurance: Trends to Watch

The auto insurance industry is witnessing a dynamic shift driven by technological advancements, evolving consumer expectations, and changes in vehicle technology. This comprehensive guide will delve into the future of car insurance, explore current auto insurance industry trends, and discuss the latest innovations in vehicle insurance. Staying informed about these developments is crucial for consumers and industry professionals to adapt and thrive in the changing landscape.

The auto insurance industry is witnessing a dynamic shift driven by technological advancements, evolving consumer expectations, and changes in vehicle technology. This comprehensive guide will delve into the future of car insurance, explore current auto insurance industry trends, and discuss the latest innovations in vehicle insurance. Staying informed about these developments is crucial for consumers and industry professionals to adapt and thrive in the changing landscape.

Technological Impact on the Future of Car Insurance

The Advent of Connected Cars

Connected cars with internet access and data-sharing capabilities are becoming more common. This technology enhances driver experience and provides insurers with real-time data to assess risk and personalize insurance premiums.

Blockchain in Auto Insurance

Blockchain technology is poised to transform the auto insurance industry by enhancing transparency and efficiency in claims processing and policy management. It could revolutionize how insurers, customers, and service providers interact.

Current Auto Insurance Industry Trends

The Shift Towards Flexible Insurance Models

A significant auto insurance industry trend is the shift towards more flexible insurance models. Pay-as-you-drive and pay-how-you-drive are becoming more popular, offering consumers cost-effective and personalized insurance solutions.

The Integration of AI and Machine Learning

Artificial intelligence and machine learning are not just transforming customer service but also underwriting and risk assessment processes. These technologies enable more accurate predictions and risk assessments, leading to fairer pricing and improved customer segmentation.

Innovations in Vehicle Insurance

Insurance Products for Electric Vehicles

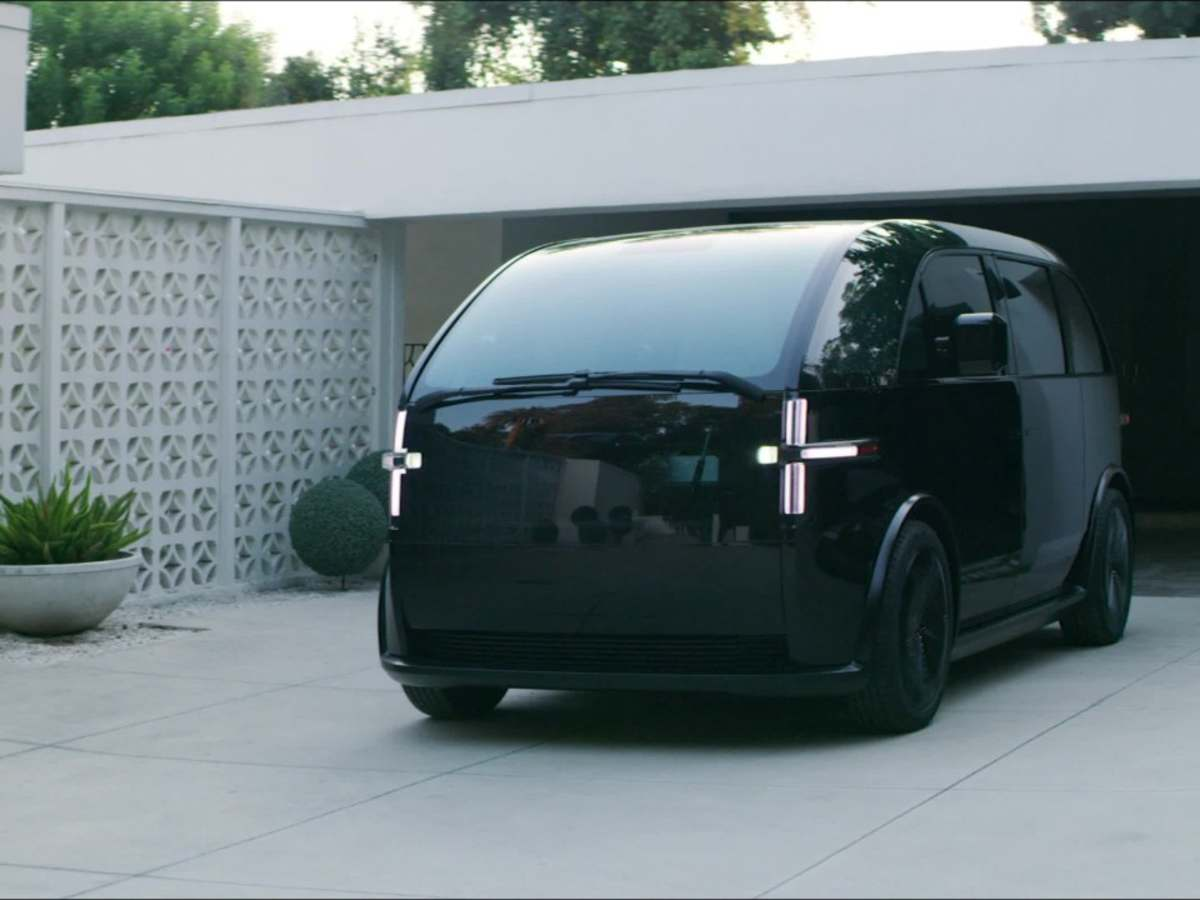

With the rise of electric vehicles (EVs), insurers are developing specialized insurance products for EV owners. These policies consider the unique aspects of EVs, such as battery life and charging infrastructure.

Peer-to-Peer Insurance Models

Another innovation in the future of car insurance is the development of peer-to-peer (P2P) insurance models. This approach leverages social networks and collective risk-sharing, potentially lowering costs and enhancing customer engagement.

Adapting to Consumer Behavior and Expectations

Demand for More Transparency and Control

Today's consumers demand greater transparency and control over their insurance policies. Insurers are responding with more user-friendly platforms and tools that allow customers to manage their policies and claims more independently.

The Rise of Personalized Insurance Products

The trend toward personalized insurance products, shaped by individual driving habits and preferences, is gaining prominence. This shift away from the traditional one-size-fits-all approach in auto insurance represents a fundamental transformation in the industry. Insurers increasingly recognise the value of tailoring policies to meet each customer's unique needs and risk profile.

Regulatory and Environmental Considerations

Compliance with Evolving Regulations

The auto insurance industry faces the challenging task of navigating a complex and ever-evolving regulatory landscape. Key focus areas include data privacy, as insurers collect and handle increasing volumes of personal information; the emergence of autonomous vehicles, which introduce new dynamics in liability and policy structuring; and innovative insurance models like usage-based insurance. Staying abreast of these regulatory changes is vital for insurers to ensure compliance and adapt their products and services accordingly.

Insurance and Environmental Sustainability

Environmental sustainability is influencing the auto insurance industry. Insurers increasingly recognize the importance of promoting eco-friendly practices, including offering incentives for eco-friendly driving and supporting sustainable transportation initiatives.

The Role of Data and Analytics

Enhancing Underwriting with Predictive Analytics

The use of predictive analytics in underwriting is revolutionizing the way insurers assess risk. By analyzing vast amounts of data, insurers can more accurately price policies and identify potential risk factors.

Data-Driven Customization of Policies

The wealth of data available to insurers allows for the customization of policies based on individual risk profiles. This data-driven approach leads to more accurate pricing and enhanced customer satisfaction.

Challenges and Opportunities in the Evolving Landscape

Navigating Cybersecurity Risks

The associated cybersecurity risks escalate correspondingly as digital technologies increasingly permeate the auto insurance industry. Insurers are thus compelled to invest heavily in robust cybersecurity measures. This necessity is to safeguard sensitive customer data against breaches and uphold and maintain consumer trust. Implementing advanced encryption, secure data storage, and regular security audits becomes paramount. Moreover, educating customers on data security practices is critical to this strategy. By fortifying their cyber defences, insurers can protect their data assets and reinforce their reputation as trustworthy custodians of personal and sensitive information in an era where data breaches are becoming increasingly common.

Opportunities in New Mobility Solutions

Emerging mobility solutions, such as ride-sharing and on-demand transportation services, present new opportunities for the auto insurance industry. Developing insurance products that cater to these modern mobility solutions can open new markets and revenue streams for insurers.

Future Trends and Predictions

Anticipating the Impact of Advanced Driver Assistance Systems (ADAS)

Advanced Driver Assistance Systems (ADAS), like automatic braking and lane-keeping assist, are becoming standard in modern vehicles. Insurers will need to consider how these technologies affect risk and adjust their policies accordingly.

The Potential of IoT and Wearables in Auto Insurance

Integrating the Internet of Things (IoT) and wearable technology in the auto insurance industry promises a profound transformation. These technologies can capture detailed driving habits and vehicle usage data, offering insights beyond traditional metrics. This can lead to more sophisticated risk assessments and the development of highly personalized insurance policies tailored to individual driving behaviours. Such advancements could result in more accurate pricing models and incentivize safer driving practices, ultimately revolutionizing how auto insurance premiums are calculated and policies are customized.

Conclusion:

In conclusion, the auto insurance industry is at a crossroads, with emerging technologies and changing consumer behaviours driving significant transformations. From telematics to AI, blockchain to electric vehicle coverage, the future of car insurance is markedly different from its past. Embracing these changes, staying informed about innovations in vehicle insurance, and adapting to new trends and regulatory landscapes will be essential for insurers and consumers. As we move forward, the industry's ability to innovate and respond to these changes will shape its success in providing effective, efficient, and customer-centric insurance solutions.