As coisas que você precisa no dia a dia para uma boa higiene bucal

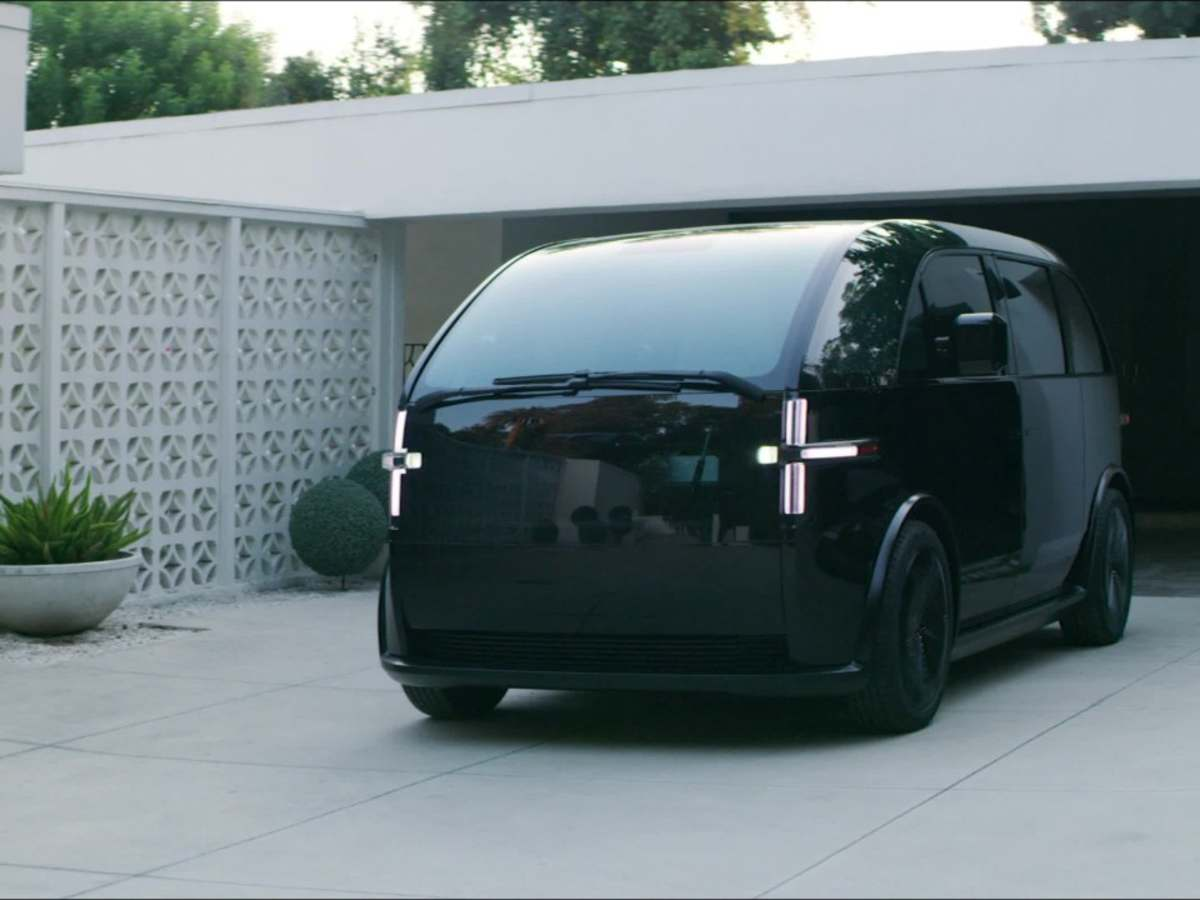

Como comprar carros seminovos sem entrada

Cost Of Walk-In Bathtubs For Seniors Might Surprise You!

13 Kostenlose KI-Bildgeneratoren, die Ihr Business voranbringen

Como comprar carros usados sem entrada: Veja as opções

Top Budget-Friendly Electric Cars for Seniors: A Smart Guide to Easy Driving

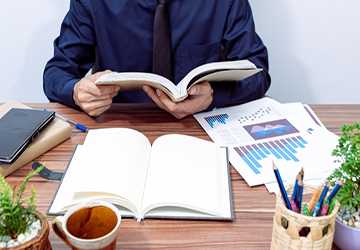

Top 10 Personal Finance Books for Every Investor

Navigating the personal finance and investing world can often feel daunting, filled with complex terminology and ever-changing market dynamics. However, a wealth of knowledge is available at your fingertips, waiting to be discovered within the pages of some remarkable books. Whether you're a novice looking to establish a solid financial foundation or a seasoned investor aiming to refine your strategy, the right books can provide invaluable insights, actionable advice, and a renewed perspective on money management. This guide will introduce you to the top 10 personal finance books that every investor should consider reading.

Navigating the personal finance and investing world can often feel daunting, filled with complex terminology and ever-changing market dynamics. However, a wealth of knowledge is available at your fingertips, waiting to be discovered within the pages of some remarkable books. Whether you're a novice looking to establish a solid financial foundation or a seasoned investor aiming to refine your strategy, the right books can provide invaluable insights, actionable advice, and a renewed perspective on money management. This guide will introduce you to the top 10 personal finance books that every investor should consider reading.

"The Intelligent Investor" by Benjamin Graham

Benjamin Graham's "The Intelligent Investor" is often called the Bible of investing. Published in 1949, it still holds relevance today. Graham teaches readers the importance of value investing and how to separate the noise from investment opportunities. The book introduces the concept of intrinsic value and offers insights into market fluctuations. What makes this book stand out is its timeless wisdom. Graham's principles have influenced some of the greatest investors of our time, including Warren Buffett. So, if you want to understand the fundamentals of investing, start here.

"Rich Dad Poor Dad" by Robert Kiyosaki

If you're looking for a book that will change your perspective on money, "Rich Dad, Poor Dad" is it. Robert Kiyosaki shares his journey growing up with two father figures: his biological dad (Poor Dad) and the father of his best friend (Rich Dad). Through engaging anecdotes and simple lessons, Kiyosaki emphasizes the importance of financial education. He challenges traditional beliefs about money, assets, and liabilities. The book serves as a wake-up call for many, urging them to rethink their approach to finances and investments. It's not just about making money; it's about understanding money.

"The Little Book of Common-Sense Investing" by John C. Bogle

John Bogle, the founder of Vanguard Group, is known for pioneering index investing. In "The Little Book of Common-Sense Investing," Bogle distils his investment philosophy into simple, actionable advice. The book emphasizes the power of low-cost index funds and the long-term benefits of staying invested. Bogle's approach challenges the notion that active trading and frequent buying/selling lead to success. Instead, he advocates for a patient, disciplined strategy focused on the broader market. Bogle's insights are invaluable if you're new to investing or looking to refine your approach.

"The Richest Man in Babylon" by George S. Clason

Who wouldn't want to learn financial lessons from the richest man in ancient Babylon? George S. Clason's classic book uses parables set in ancient times to impart timeless wisdom about money management. Each story in "The Richest Man in Babylon" offers practical advice on saving, investing, and growing wealth. From the importance of paying yourself first to the value of sound financial advice, Clason's lessons are simple and profound. This book serves as a reminder that wealth-building principles have remained unchanged for centuries.

"Your Money or Your Life" by Vicki Robin and Joe Dominguez

"Your Money or Your Life" challenges readers to question their relationship with money and redefine their values. Vicki Robin and Joe Dominguez present a nine-step program designed to transform your finances and, by extension, your life. The book encourages readers to examine their spending habits and earnings and align their financial goals with their values. It's not just about accumulating wealth; it's about achieving financial independence and reclaiming your time and freedom. Robin and Dominguez's approach is practical and philosophical, making it a must-read for anyone seeking financial enlightenment.

"The Millionaire Next Door" by Thomas J. Stanley and William D. Danko

"The Millionaire Next Door" challenges common perceptions about wealth and affluence. Stanley and Danko conducted extensive research to uncover the habits and lifestyles of America's millionaires. Surprisingly, many millionaires live modestly and prioritize savings and investments over conspicuous consumption. The book highlights the importance of frugality, financial discipline, and long-term planning. It serves as a reminder that building wealth is often a result of consistent habits rather than high income. If you want to understand the mindset of millionaires and learn from their success, this book is must-read.

"Common Stocks and Uncommon Profits" by Philip A. Fisher

Philip Fisher is renowned for his investment philosophy of identifying high-quality growth stocks. In "Common Stocks and Uncommon Profits," Fisher outlines his approach to investment research and stock selection. The book emphasizes the importance of qualitative analysis, including understanding a company's management, competitive advantages, and growth potential. Fisher's insights into long-term investing and the value of patience have influenced generations of investors. This book offers invaluable guidance if you're interested in growth investing and understanding the qualitative aspects of company analysis.

"A Random Walk Down Wall Street" by Burton G. Malkiel

"A Random Walk Down Wall Street" is a classic that explores the principles of investing and the efficiency of financial markets. Burton Malkiel introduces readers to the "random walk," suggesting that stock prices reflect all available information and follow a random pattern. The book covers various topics, from portfolio management and asset allocation to behavioural finance and the pitfalls of active trading. Malkiel's engaging style and comprehensive coverage make complex financial concepts accessible to readers of all backgrounds. Whether you're a novice investor or a seasoned pro, this book offers valuable insights into the nature of financial markets and investment strategies.

"The Four Pillars of Investing" by William J. Bernstein

William Bernstein's "The Four Pillars of Investing" provides a comprehensive framework for building a successful investment portfolio. Bernstein emphasizes the importance of understanding the historical context of financial markets and the role of risk and reward in investment decisions. The book explores four essential pillars: the theory of investing, the history of financial markets, the psychology of investing, and the business of investing. Bernstein's approach combines academic rigour with practical advice, offering readers a balanced perspective on investment strategies and market behaviour. If you're looking for a well-rounded guide to investing, this book is an excellent resource.

"The Bogleheads' Guide to Investing" by Taylor Larimore, Michael LeBoeuf, and Mel Lindauer

"The Bogleheads' Guide to Investing" is a practical handbook for individual investors seeking to follow the principles of John Bogle's investment philosophy. The Bogleheads community, named after Bogle himself, advocates for simplicity, low costs, and a long-term perspective in investing. The book covers various topics, including asset allocation, retirement planning, and tax-efficient investing. With contributions from multiple Bogleheads members, the book offers diverse perspectives and real-world examples to help readers navigate the complexities of the financial markets. If you're looking for a straightforward and actionable guide to investing, this book is a valuable resource.

Conclusion

These five books offer investors a wealth of knowledge (pun intended) at any stage of their journey. Whether you're a beginner looking to build a solid foundation or a seasoned investor seeking to refine your strategy, these books provide invaluable insights and advice. So, grab a copy, dive in, and take control of your financial future!